Parabolic SAR

Introduction

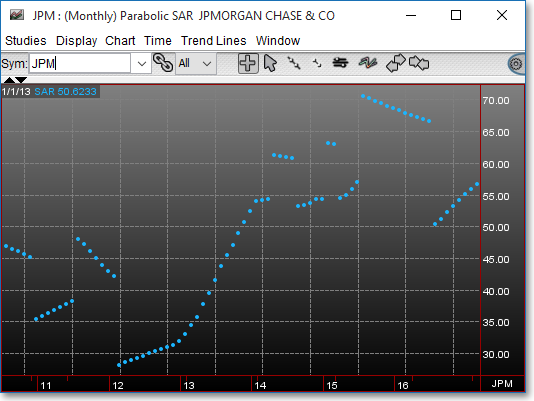

The Parabolic Time/Price System was developed by Welles Wilder. This indicator is used to set trailing price stops and is usually referred to as the SAR (stop and reversal). The Parabolic SAR is a trending indicator that clearly defines when a symbol is in an uptrend or a downtrend.

The Parabolic SAR is defined by a small dot that is located above or below bars of a bar chart. When the SAR value is above the bar, the symbol is in a downtrend, and when the SAR is below the bar, the symbol is in an uptrend.

Once a trend is defined, the Parabolic value will move above or below the previous value every day until the indicator reverses. This is because the Parabolic System is a function of price and time.

Application

The Parabolic SAR is commonly used to exit positions. Because the SAR is a trending indicator, it does an excellent job of finding where one trend ends and a new one begins. Bearish indications are given when the SAR value changes from being below the previous bar to going above the current bar. Bullish indications are given when the SAR value changes from being above the previous bar to going below the current bar.

Although the Parabolic SAR is commonly used for finding exit points, it can also be used to find entry points. For a more detailed explanation of the Parabolic SAR and for information on how the Parabolic SAR is calculated, refer to Mr. Wilder's book, New Concepts in Technical Trading Systems.

Chart Settings

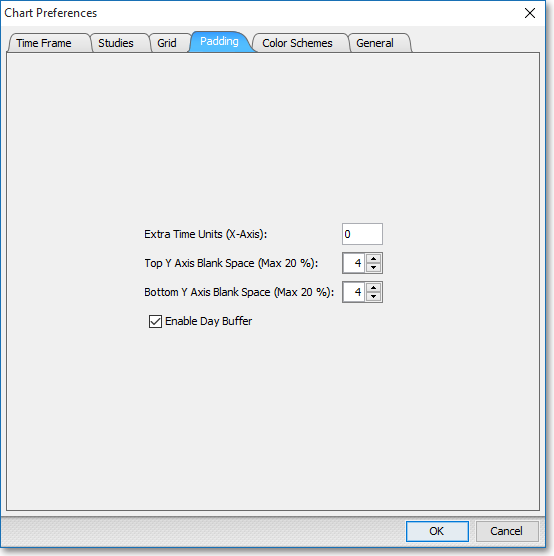

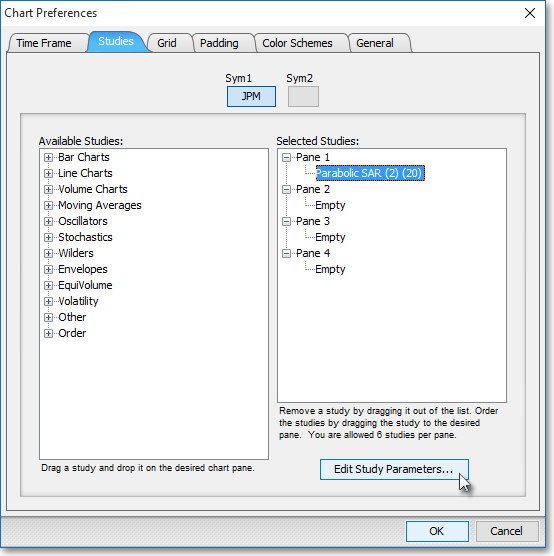

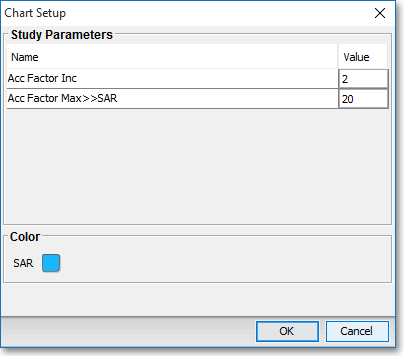

Once the Parabolic SAR technical indicator is selected in a Chart window, you may click with the right mouse button in the body of the Chart window and select "Preferences" to access the "Studies" tab. Once there, you may select the study you wish to edit (in this example, "Parabolic SAR (2) (20)" is selected), and then click "Edit Study Parameters" in order to enter the acceleration factor and maximum acceleration value used in the calculation.

ACC Factor Inc: This parameter lets you enter the acceleration factor to be used in the Parabolic calculation.

ACC Factor Max > > SAR: This parameter lets you enter the maximum acceleration value to be used in the calculation. When the acceleration factor reaches this value, it will not be increased, regardless of the instrument's activity.

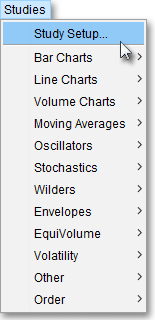

Note: You may also access the "Chart Setup" window by clicking on "Studies" and selecting "Study Setup..." from the drop-down menu.

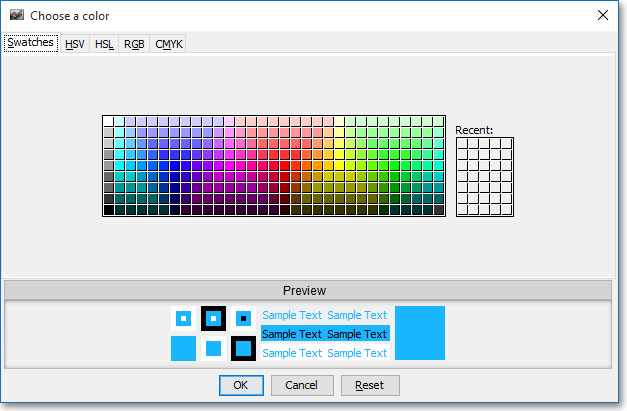

Note: If you wish to change the color of the Chart's lines, simply click on the square to the right of "SAR" respectively to cause the "Choose a Color" box to appear. The "Choose a Color" box contains five tabs: "Swatches," "HSV," "HSL," "RGB," and "CMYK." The "Swatches" tab lets you select one of several color "swatches" to replace the existing component color of the selected color scheme. The "HSV," "HSL," "RGB," and "CMYK" tabs let you edit the color of the selected swatch. If at any time you do not like the color of the swatch you selected or you do not like the color changes you have made to the swatch itself, click Reset to return to the existing component color of the selected color scheme. Once you have selected a replacement color, click OK.

Formula

SARn = SARn-1 + AF (EP – SARn-1)

Where:

SARn =

Current Parabolic SAR Value

SARn-1 = Previous Parabolic SAR Value

AF = Acceleration

Factor

EP = Extreme Price Point

for the Trade

Note: If the trade is long, EP will equal the highest high before reversal occurs. If the trade is short, EP will equal the lowest low before the reversal occurs.