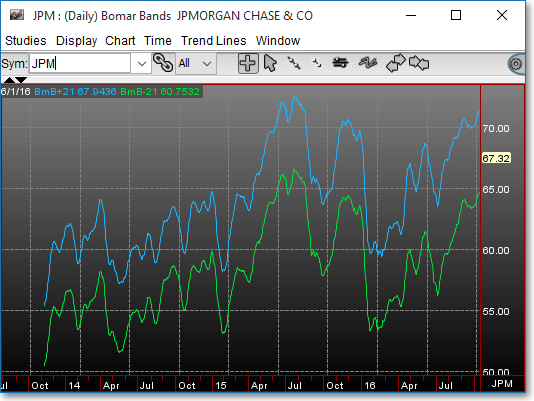

Bomar Bands

Marc Chaikin of Bomar Securities, in attempting to find some way to have the market set the band widths rather than the intuitive or random-choice approach used before, added to the study of Bollinger Bands by suggesting that the bands be constructed to contain a fixed percentage of the data over the past year. Bomar suggested that this new study represent the 21-day average and that the bands ought to contain 85% of the data. Thus, the bands are shifted up 3% and down by 2%. Bomar bands were the result. The width of the bands is different for the upper and lower bands. In a sustained bull move, the upper band width will expand and the lower band width will contract. The opposite holds true in a bear market. Not only does the total band width change across time, the displacement around the average changes as well.