Spreads Tab

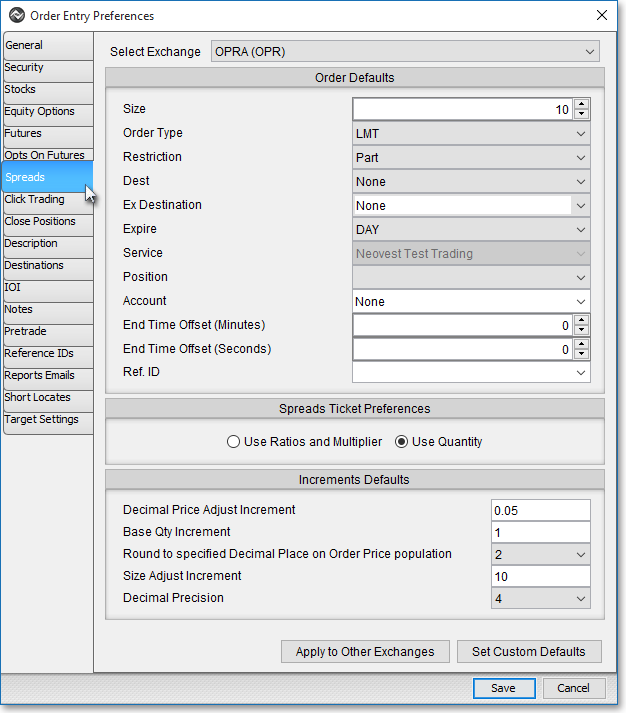

Features in the "Spreads" tab in Neovest's "Order Entry Preferences" box let you specify personal defaults for Neovest's Spreads (Options Strategies) window. Defaults that you may specify include "Exchange," "Size," "Order Type," "Expire," "Ex Destination," "Position," and "Account."

The following instructions explain how you may specify defaults for Neovest's Spreads (Options Strategies) window via the "Spreads" tab in Neovest's "Order Entry Preferences" box:

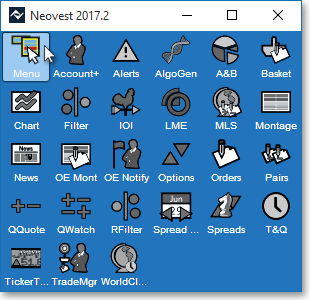

Click the "Menu" icon in Neovest's Launch Pad.

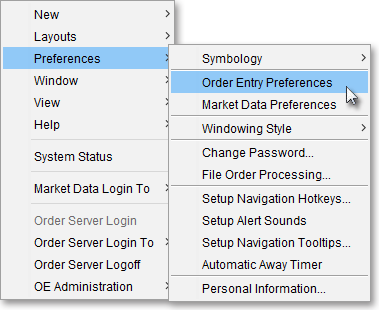

Select Preferences | Order Entry Preferences.

Once the "Order Entry Preferences" box appears, select the "Spreads" tab.

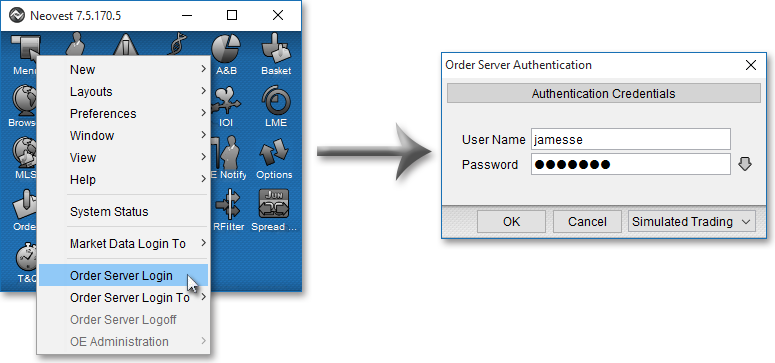

Note: If you are not logged in to Neovest's Order Entry Server at the time you attempt to select the "Spreads" tab, then Neovest will not allow you to select the "Spreads" tab. To quickly log in to Neovest's Order Entry Server, simply click on the "Menu" icon in Neovest's Launch Pad, select Order Server Login, type your "User Name" and "Password" in their respective boxes once the "Order Server Authentication" box appears, and click OK.

Once you access the "Spreads" tab in Neovest's "Order Entry Preferences" box, you may specify defaults for Neovest's Spreads (Options Strategies) windows.

The following table provides descriptions of the defaults in the "Spreads" tab that you may specify:

| Feature: | Description: |

| Select Exchange | Lets you select an exchange for which you would like to set defaults. If you select an exchange, then any specifications you make to size, order type, destination, etc. will be saved as the default settings for your selected exchange. Currently, the exchange for which you may specify defaults is the Options Price Reporting Authority (OPRA). |

| Size | Lets you specify a default size. |

| Order Type | Lets you select

one of ten different default order types: "Direct+," "LMT," "LOB," "LOC," "MKT," "MOC," "ONC," "PEG," "SLMT," and "STOP."

Note: Each destination supports different order types; therefore, as you select different destinations, the availability of certain order types will change. The following ten rows provide descriptions of the main order types that are available to you. |

| Order Type: Direct+ |

If you select Direct+ as the order type, then the order will be filled using NYSE's Direct+® automatic-execution service, which will electronically execute the order at the best bid or offer. To select Direct+ as the order type, the order must be a Limit order with a size of less than 1,099 shares. |

| Order Type: LMT (Limit) |

If you select LMT as the default order type, then the order will be filled only if the entered symbol reaches or betters the price specified in the "Limit Price" field. |

| Order Type: LOB (Limit Or Better) |

If you select LOB (you must select ARCA as the destination for Limit Or Better to be available) as the order type, then the order will be matched first with the ARCA Book if ARCA is at the inside Limit Price. If ARCA is not at the inside Limit Price, then the order will be routed for immediate execution to a select group of market participants at the inside Limit Price. If any volume remains, the residual volume will be filled at the inside Limit Price or better with ARCA or with other market participants. |

| Order Type: LOC (Limit On Close) |

If you select LOC as the order type, then the order will be filled as a Limit order as close as possible to the end of the current day. |

| Order Type: MKT (Market) |

If you select MKT as the default order type, then the order will be filled at the current market price. |

| Order Type: MOC (Market On Close) |

If you select MOC as the order type, then the order will be filled as a Market order as close as possible to the end of the current day. |

| Order Type: PEG |

If you select

PEG as the order type, then various pegging order types will appear

in the "Pegging" field menu.

Note: Each destination supports different order types; therefore, as you select different destinations, the availability of certain pegging order types will change. For more information, refer to the "Pegging" information in this table. |

| Order Type: SLMT (Stop Limit) |

If you select SLMT as the order type, then the order will be filled only if the entered symbol reaches or betters the price specified in the Stop Price field but does not exceed the price specified in the Limit Price field. You should enter a SLMT order below the current price if you are selling and above the current price if you are buying. Sell SLMT orders are generally used to limit potential losses on long stock positions in falling markets, and buy SLMT orders are generally used to protect against an upside risk if a stock has been shorted. What differentiates a SLMT order from a STOP order specifically is the price entered in the Limit Price field, which is designed to "stop" a buy or sell order from being filled if the price of the symbol exceeds the Limit Price. Once the order reaches or betters the price specified in the Stop Price field, a Limit order will be immediately generated. |

| Order

Type: STOP |

If you select STOP as the default order type, then the order will be filled only if the entered symbol reaches or betters the price specified in the "Stop Price" field. You should enter a STOP order below the current price if you are selling and above the current price if you are buying. Sell STOP orders are generally used to limit potential losses on long stock positions in falling markets, and buy STOP orders are generally used to protect against an upside risk if a stock has been shorted. Once the order reaches or betters the price specified in the Stop Price field, a Market order will be immediately generated. |

| Restriction | Lets you select either "Part" or "AON" (all or nothing) as the order restriction. |

| Expire: DAY | Lets you select

"DAY" as the order expiration type, which will cause that the order must be filled by the end

of the current day or the order will be canceled. Note: Each destination supports different expiration types; therefore, as you select different destinations, the availability of certain expiration types will change. The proceeding four rows provide descriptions of the main expiration types that are available to you. |

| Dest (Destination) |

Lets you select a default destination. For information on the destinations that Neovest currently supports, refer to the "Order Entry Destinations" section in the "Orders" chapter of Neovest's Help documentation. |

| Ex

(Exchange) Destination |

Lets you select a default exchange destination. If you select a particular default exchange destination, then the default destination that you selected in the "Destination" field will route your options orders to the default exchange destination you selected. |

| Service | Lets you select a default order service, which in turn controls the destinations that are available to you. |

| Position | Lets you specify whether the default resulting position after each options order has executed will be an opening position ("OPEN") or a closing position ("CLOSE"). |

| Account | Lets you select a default account. |

| Option Types |

Lets you choose to display certain information in the "Option Type" display field in an Options window. Once you choose to add the Option Type display field, information such as "Standard," "Weekly," "Quarterly," and so on relating to each options contract will appear. |

| Spreads Ticket Preferences |

Lets you select "Use Ratios and Multiplier" or "Use Quantity" as your default setting. |

The following table provides descriptions of the features in the "Spreads" tab that you may use to specify the increments by which prices and order sizes may be adjusted in a Neovest Spreads (Options Strategies) window:

| Feature: | Description: |

| Decimal Price Adjust Increment | Lets you specify the "Decimal Price Adjust Increment," which is the incremental number by which option prices are adjusted higher or lower in the "Limit Price" field in a Spreads window. |

| Round to Specified Decimal Place on Order Price Population | Rounds the order price population to the hundredths. |

| Price Increment Multiplier | Lets you specify the "Price Increment Multiplier," which is used in association with international symbols that increment in price denominations other than pennies. For instance, the symbol "VOD.L" increments in denominations of five pence, so if you wish to increase the price of VOD.L in a Spreads window and if the value entered in connection with this feature is "1," then Neovest will increase VOD.L's price by increments of five. If you entered "2" in this feature's box, then Neovest will increase VOD.L's price by increments of 10, and so on. |

| Size Adjust Increment | Lets you specify the "Size Adjust Increment," which is the incremental number by which order sizes are adjusted higher or lower in the "Size" field for a Spreads window. |

| Decimal Precision | Lets you specify the maximum number of decimal places shown in a given value. For example, selecting "1" will round all decimal numbers to the tenths value; selecting "2" will round all decimal numbers to the hundredths value; and so on. |

Once you have changed the desired personalized defaults for Neovest Spreads, click Save.