Trade Manager Window Introduction

Neovest's Trade Manager window is designed to function as an order staging platform from which portfolio traders may receive target orders from their portfolio managers. The term "portfolio" in Neovest refers to an individual account for which a target order may be created and traded. Portfolios may be used to organize your trades into manageable groups for trading in specific sectors. In addition, you may separate a single portfolio into sections, or you may rebalance an entire portfolio.

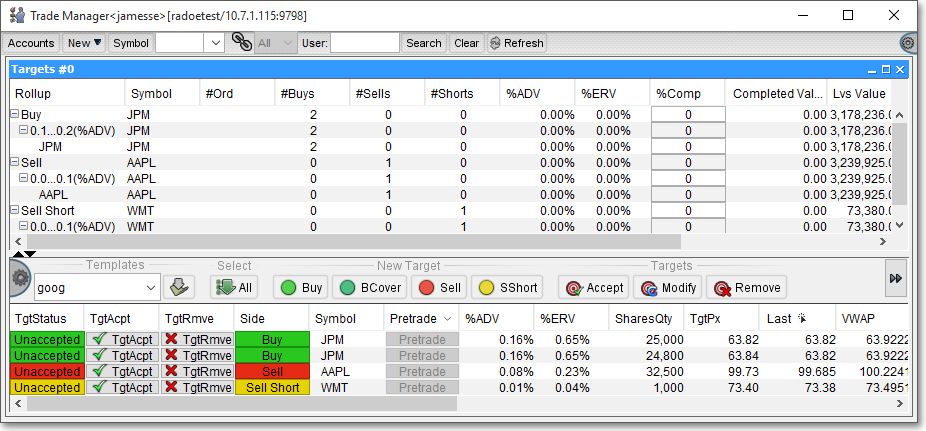

Within a Trade Manager window, you may manage sector holdings; view positions, working orders, and completed orders; separate longs and shorts within a portfolio; manage targets for parent/child workflow; organize trades and lists for easier management; and load and manage lists from a spreadsheet or directly to your order management system (OMS). To compliment Trade Manager's varied functions, hundreds of data points are available to help traders and PMs make trading decisions.

Neovest provides connectivity with all major third-party OMSs. Once a target order is generated via an OMS, the target will be recognized and staged automatically into Neovest either associated with a specified portfolio or unassociated as a stand-alone target to be allocated later. Portfolio traders may then begin to buy or sell against the targets to execute orders relating to their assigned portfolios.

The Trade Manager window gives traders the ability to execute received target orders strategically all at once, in groups, or individually.

For instance, a portfolio trader may trade a particular basket of stocks together at the open using Neovest's Trade Manager window by first creating unique target orders for each symbol within the basket prior to the open and then executing the entire list simultaneously. Features within the window would then allow the portfolio trader to monitor the executions of the orders within the basket in real time.

Order Management

As stated earlier, Neovest's Trade Manager window is designed to let portfolio managers enter multiple target orders that may then be accepted and worked by individual portfolio traders. Once an individual target order has been accepted by a portfolio trader, a portfolio manager may monitor the trading activity of the trader by viewing real-time data relating to the overall execution of the target order.

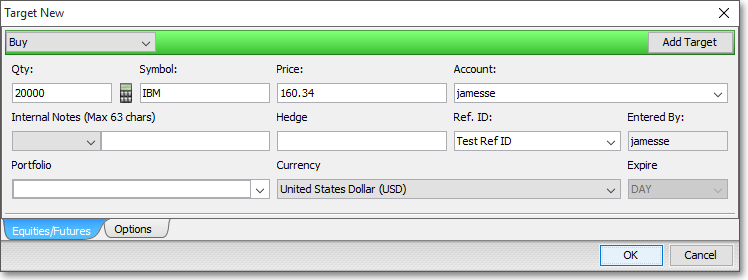

For example, if a portfolio manager wishes one of his portfolio traders to buy 20,000 shares of the symbol IBM, then he may enter the target order in his Trade Manager window.

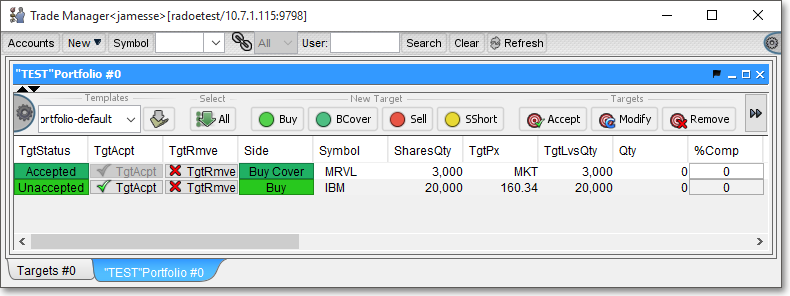

Once a trader accepts the target order and begins to work orders to fill its displayed quantity, the portfolio manager may monitor the real-time trading activity of his trader. Neovest's Trade Manager window's continuously updating data, for example, may then reveal that his trader has executed two orders towards the overall execution of the target order, the first being a 3,000-share order at a price of MKT and the second being a 20,000-share order at a price of $160.34.

Once orders have been executed against a particular target order, a trader may click on the plus sign in the "Symbol" display field associated with the target order to view the real-time average prices, total shares traded, and total dollar values relating to the specific executions on the target order's behalf.

Neovest's Trade Manager window is divided into various sections and tabs with display fields that reveal data such as "Symbol," "Buy/Sell," "Target Status," "Target Quantity," "Order Quantity," "Broker Strategy," "Average Price" and "Volume." Neovest's Help menu provides descriptions of each of Neovest's hundreds of display fields.

The Trade Manager window also contains an account tree view section, which displays the accounts or portfolios to which a particular trader has access. Within this section, portfolio traders have the ability to add, remove, and rename accounts and refresh the specific symbol and order information associated with each account.

Searching and Communication

If a particular Trade Manager window contains numerous orders and positions, then the window's toolbar may be utilized to search for specific symbols, users, accounts, destinations, prices, and various order and position data. The toolbar also features several useful icons that let traders access Neovest's Trade Manager window "Preferences" box, save and clear the default Trade Manager window, refresh the view in a Trade Manager window, and perform other functions.

The Trade Manager window is also an extremely effective communication tool. Using default features in the window, portfolio managers and traders who share access to each other's accounts may quickly create, assign, and accept target orders; write and view notes for and assign user names to individual target orders; and post personal availability status messages such as Off The Desk and Busy for others to see. Incidentally, the "Off the Desk" feature may be very useful to any trader as a means of clearing any pending target orders from his Trade Manager window that he previously accepted.

Importing and Exporting

Neovest also provides features that let you import symbol and order data into a Trade Manager window that you have saved in a file using either a Trade Manager window itself or programs outside of Neovest. Files that you may import into Neovest may be created in programs such as Microsoft Excel ® and Microsoft Notepad ®, which let you save files in a comma-, semicolon-, space-, or tab-delimited format.

And for exporting purposes, the symbol and order data that are displayed in the certain tabs of a Neovest Trade Manager window may be saved and exported in a data file for importing into other Trade Manager windows or into other software applications. Neovest lets you determine the format in which each data file is to be saved and exported. For instance, you may choose to save the current symbol and order data that are displayed in certain tabs in a ".csv" format, which is a standard used by other programs such as Microsoft Excel ®.

Neovest's Help menu documentation provides complete instructions regarding how portfolio managers and individual traders may stage orders; execute, modify and cancel orders; view various profit and loss, averages, total shares traded, total dollar values, and other calculations relating to orders; set personal Trade Manager window defaults; search for specific symbols and target orders upon which you have positions; and import and export Trade Manager window data. Instructions are also provided that explain how portfolio managers and traders may save a customized Trade Manager window as the default and save an open Trade Manager window in a Neovest layout.