Trade Manager Templates

Did you know?

Neovest lets you create, name, and save Templates in a Trade Manager window. This functionality lets you load and interchange saved sets of selected data, order command buttons, and other preferences quickly in a Trade Manager window.

Among the varied functions Neovest's Template feature provides, you may:

Manage your working orders

View all of your executed orders

Perform pre-trade analysis on targets

Streamline sending individual or basket orders to the market

Perform post-trade analysis on targets or individual orders

Display multiple views of your holdings

Quickly change summarized roll-ups of data for your targets, orders, or holdings

Neovest's Trade Manager is an extremely powerful and flexible window, providing you with the ability to view positions, monitor working orders, and review completed orders. This window also lets you manage targets for parent/child order workflow and work baskets or portfolios. Additionally, there are hundreds of data display fields available to assist you with planning and execution. Templates are designed in part to aid in the organization of Neovest's data display fields into logical groupings.

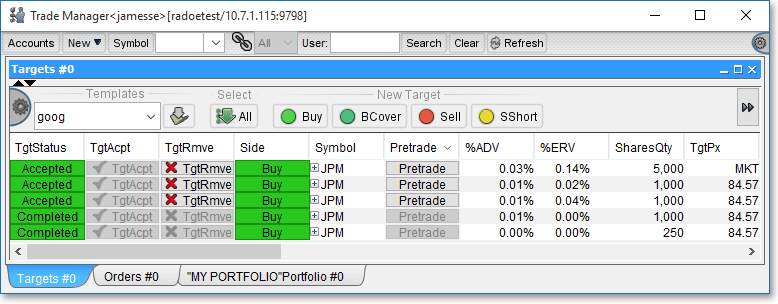

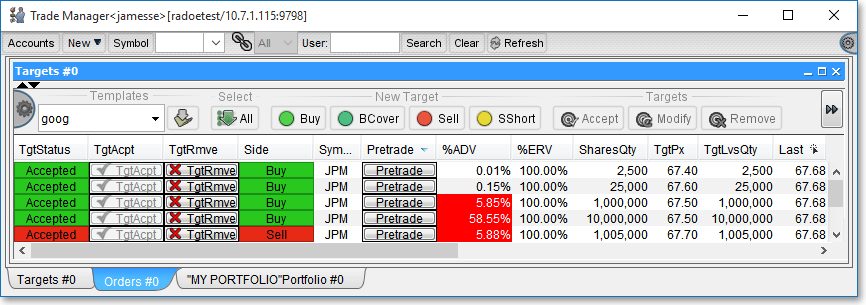

Pre-Trade Analysis

The following window shows not only the size of the orders in the basket but also the percentages of average daily volume and the estimated remaining volume for each order. Note how items that may be out of a particular trader's comfort zone are highlighted to draw attention.

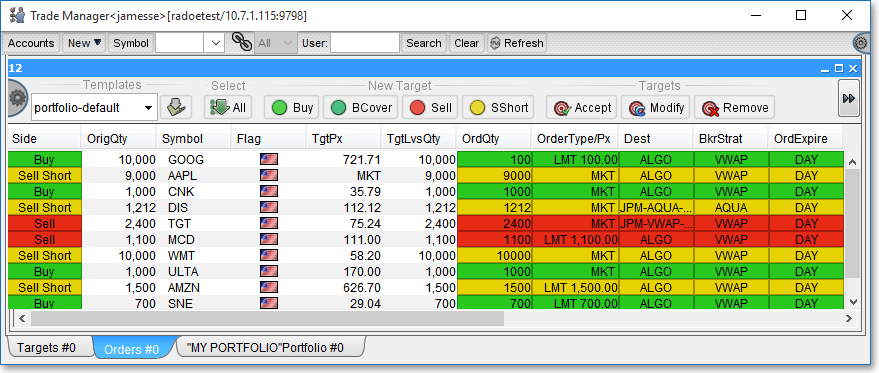

Trading

The following window shows only those fields that are necessary to place trades into the market.

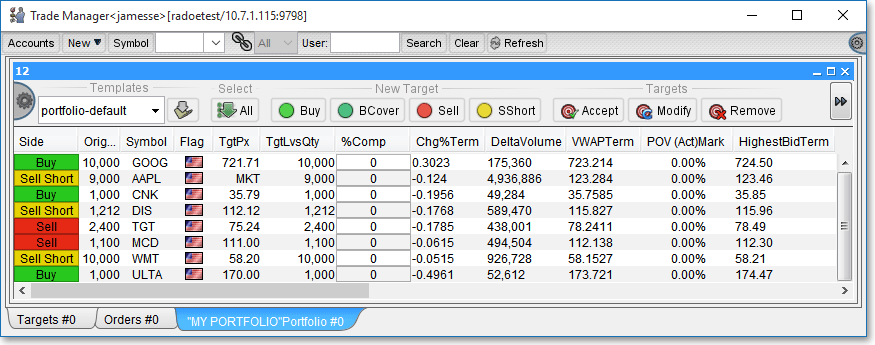

Post-Trade Analysis

The following window shows a sampling of fields that could be used for post- or in-trade analysis of your targets or orders, including Chg%Term (the percentage of change during the life of your order), DeltaVolume (how much volume was executed from the time the target or order was created), VWAPTerm (the VWAP for the life of your order), VWAP Cost Term (the cost or differential of your average price versus the VWAP, in basis points), POV (Act)Mark (your actual percent of the executed volume), and HighestBidTerm (the highest Bid price during the life of your order).