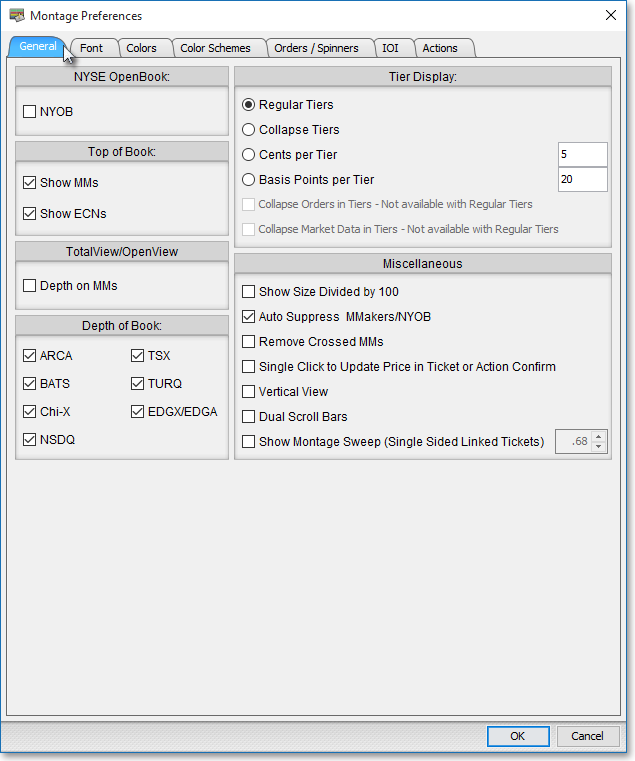

General Tab

Features in the "General" tab in Neovest's "Montage Preferences" box let you determine the information to be displayed and allows you to change the format of various components in the market maker, ECN, and regional exchange section in a Neovest Order Entry Montage window.

The following instructions explain how you may specify settings in the "General" tab for the market maker, ECN, and regional exchange section in a Neovest Order Entry Montage window:

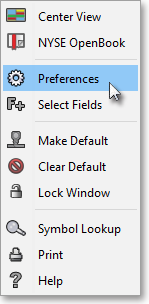

With an Order Entry Montage window open on your screen, click the gear icon, located on the far-right of the toolbar.

Click the "Preferences" icon on the drop-down menu that appears.

Once the "Montage Preferences" box appears, select the "General" tab.

The following table provides descriptions of the features in the "General" tab that you may use to specify settings for the market maker, ECN, and regional exchange section in a Neovest Order Entry Montage window:

| Feature: | Description: |

| NYSE Open Book | Lets you view the NYSE Limit Order Book on a particular NYSE-traded symbol. If you select this feature, the market maker, ECN, and regional exchange section in a Order Entry Montage window will only display NYSE Limit Order Book information once you enter a NYSE-traded symbol. |

| Top of Book | Lets you choose whether to show only the market makers or to show only the ECNs (instead of both) that represent a current buy (Bid) or sell (Ask) order for each symbol you enter in the Order Entry Montage window. |

| TotalView/ OpenView |

Lets you utilize NASDAQ's TotalView/OpenView feature to view the market depth on a particular NASDAQ-traded symbol. If you select this feature, the market maker, ECN, and regional exchange section in a Order Entry Montage window will provide you with direct access to the displayed quotes and orders of interested NASDAQ market makers on each NASDAQ-traded symbol you enter. |

| Depth of Book | Lets you select an ECN to view all of its bids and asks on each symbol you enter, rather than just its best bid and ask in the Order Entry Montage window. If you wish, you may select more than one ECN. |

| Regular Tiers | Causes the Order Entry Montage

window to separate into tiers all of the market makers and ECNs that

represent a current buy (Bid) or sell (Ask) order for each symbol

you enter. Note: You may quickly switch to this view in a Order Entry Montage window by first clicking in the Order Entry Montage section in a Order Entry Montage window and then pressing Ctrl+1. |

| Collapse Tiers | Causes the Order Entry Montage

window to merge into one tier all of the market makers and ECNs that

share the same bid price or ask price for each symbol you enter. If

this feature is selected, then the "ID" column value on

each tier will reflect the number of market makers and ECNs that currently

represent bids or asks at the price displayed at that tier, and the

"Size" column value on each tier will reflect the total

combined bid or ask size at that tier. Note: You may quickly switch to this view in a Order Entry Montage window by first clicking in the Order Entry Montage section in a Order Entry Montage window and then pressing Ctrl+2. |

| Cents Per Tier | Causes the Order Entry Montage

window to decrease each succeeding bid tier and increase each succeeding

ask tier by the number of cents specified in the "Cents Per Tier"

box. For example, if this feature is selected and the current Cents

Per Tier value is 5 and the current best bid price for the symbol

IBM is 79.55—then the "ID" column value on the first

bid tier in the Order Entry Montage window would reflect how many market makers

and ECNs currently represent a bid at 79.55 on IBM; the second tier

would reflect how many represent a bid at 79.50, and so on; and the

"Size" column value on each tier would reflect the total

combined bid or ask size at that tier. Note: You may quickly switch to this view in a Order Entry Montage window by first clicking in the market maker, ECN, and regional exchange section in a Order Entry Montage window and then pressing Ctrl+3. |

| Basis Points Per Tier | Causes the Order Entry Montage

window to decrease each succeeding bid tier and increase each succeeding

ask tier by a calculated number of cents, determined by each entered

symbol's best bid price or ask price and the number of Basis Points

specified in the "Basis Points Per Tier" box. To determine

the number of cents that separates each tier, Neovest uses the formula

of 100 Basis Points equals one percent of a symbol's best bid price

or ask price. Therefore, if a symbol's best bid price is 50 and

the default of 20 is used as the number of "Basis Points Per

Tier," then each bid tier would be divided by ten cents or 0.1.

If this feature is selected, then the "ID" column value

on each tier will reflect the number of market makers and ECNs that

represent a current bid or ask at the price displayed at that tier,

and the "Size" column value on each tier will reflect the

total combined bid size or ask size at that tier. Note: You may quickly switch to this view in a Order Entry Montage window by first clicking in the market maker, ECN, and regional exchange section in a Order Entry Montage window and then pressing Ctrl+4. |

| Show

Size Divided by 100 |

Causes the Order Entry Montage window to divide all bid and ask share sizes by 100. For example, if this feature is selected and the INET ECN currently represents a bid for 1500 shares on the symbol IBM at 79.55 per share, then the Order Entry Montage window would display "INET 79.55 15." Also, if the share size is less than 100, then the size will show as "1." |

| Auto

Suppress MMakers/ NYOB |

Causes the Order Entry Montage window to suppress all market makers and the New York Open Book after the market close. If this feature is selected, then after market close Neovest will automatically remove all market maker and New York Open Book information from the Order Entry Montage window and will leave all ECN information for after market trading. |

| Remove Crossed MMs | Causes the Order Entry Montage window to remove all crossed market makers. If this feature is selected, then Neovest will remove all market makers that are displaying asks lower than the bids and bids higher than the asks. |

| Single Click to Update Price in Ticket or Action Confirm |

Causes an Order Entry Montage window to update a ticket or action confirm window with a single click. If this feature is selected, then you may click on any market maker's row of bid or ask data in the market maker, ECN, and regional exchange section

in an Order Entry Montage window and the price that is associated with the data will appear in the ticket or action confirm window. Note: By checking this feature, the double-click component will be disabled. Thus, you may choose either the double-click feature or the single-click feature to use when clicking on a symbol's price in the market maker, ECN, and regional exchange section in an Order Entry Montage window to populate a ticket or action confirm with the data you have selected. Keep in mind this feature only applies to a Neovest Order Entry Montage window. |

| Vertical View | Causes the Order Entry Montage window to sort its market maker data by price. If this feature is selected, then Neovest will separate its market maker data into two vertical columns, sorted by price. |

| Dual Scroll Bars | Causes the Order Entry Montage window to add scroll bars to the market maker bid and ask sections. If this feature is selected, then Neovest will allow you to scroll through the market maker bid and ask sections individually. |