Options Symbol Initiative (OSI)

Due to the February 2010 Options Symbol Initiative (OSI), Neovest has developed new symbology for entering options symbols in Neovest windows.

As of 12 February 2010, you must be using Neovest version 5.5 to trade options.

In most cases, the underlyer is all that is required, but within some Neovest windows you may enter the options symbol itself. In these cases, Neovest's new symbology will be used. Since OPRA provides Neovest with its market data, Neovest utilized OPRA's options symbology as a model in developing Neovest symbology.

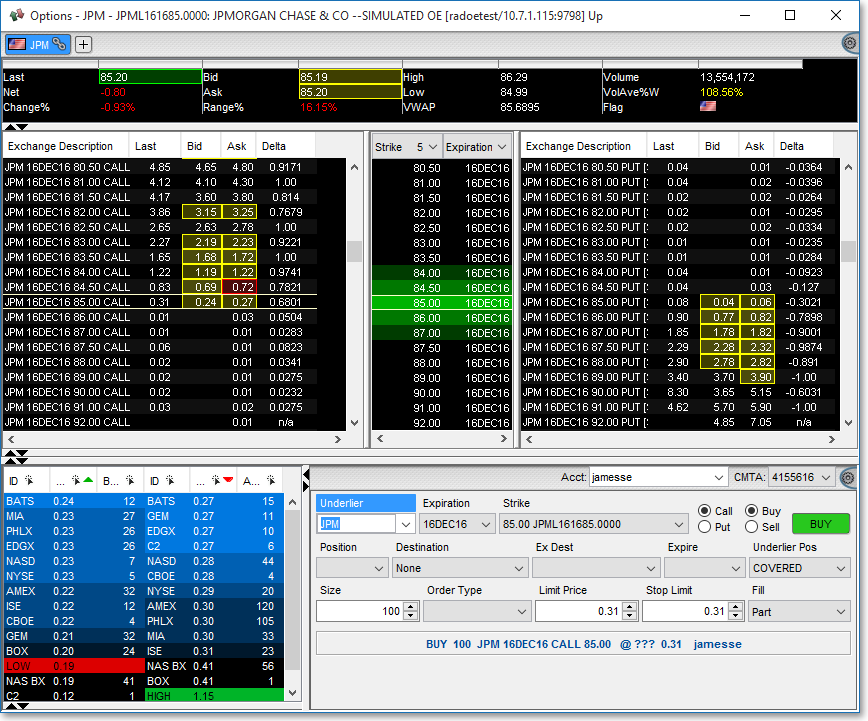

The following graphic displays Neovest's Options window with Neovest's new post-conversion, pre-consolidation symbology on the symbol of JPM:

Note: Neovest continues to show expiration codes that identify the month/call/put in an effort to reduce the size of the symbol. The month codes are shown below:

|

Expiration Month Codes |

||||||||

|

|

Code |

|

Code |

|

Code |

|||

|

Month |

Call |

Put |

Month |

Call |

Put |

Month |

Call |

Put |

|

JAN |

A |

M |

FEB |

B |

N |

MAR |

C |

O |

|

APR |

D |

P |

MAY |

E |

Q |

JUN |

F |

R |

|

JUL |

G |

S |

AUG |

H |

T |

SEP |

I |

U |

|

OCT

|

J |

V |

NOV |

K |

W |

DEC |

L |

X |

Neovest Symbology

As an example, note Neovest's new post-conversion, pre-consolidation symbology on the symbol DELL (length of 13 to 17 characters –no spaces):

Symbol: DLYB201014.0000

| Neovest Symbology | ||||

Symbol |

Month |

Day |

Year |

Explicit Strike Price |

DLY |

B |

20 |

10 |

14.0000 |

As a further example, note Neovest's new post-consolidation symbology on the symbol DELL (length of 13 to 17 characters –no spaces):

Symbol: DELLB201014.0000

| Neovest Symbology | ||||

Symbol |

Month |

Day |

Year |

Explicit Strike Price |

DELL |

B |

20 |

10 |

14.0000 |

Transition Schedule

The transition to the new OSI symbology will take place industry-wide in two steps: Conversion and Consolidation. The most complicated aspect of this will be the Conversion on 12 February 2010. The Consolidation will then be performed symbol by symbol.

Highlights:

Conversion on 12 February 2010 will still contain the old root but will include the new symbology.

Consolidation will cause the old root to be replaced by the actual underlyer. (Consolidation dates are different for each symbol.)

For example:

Prior to 12 February 2010: DLYBP (DELL/Call/20 February 2010/$14.00 Strike)

After Conversion: DLYB201014.0000

After Consolidation: DELL201014.000