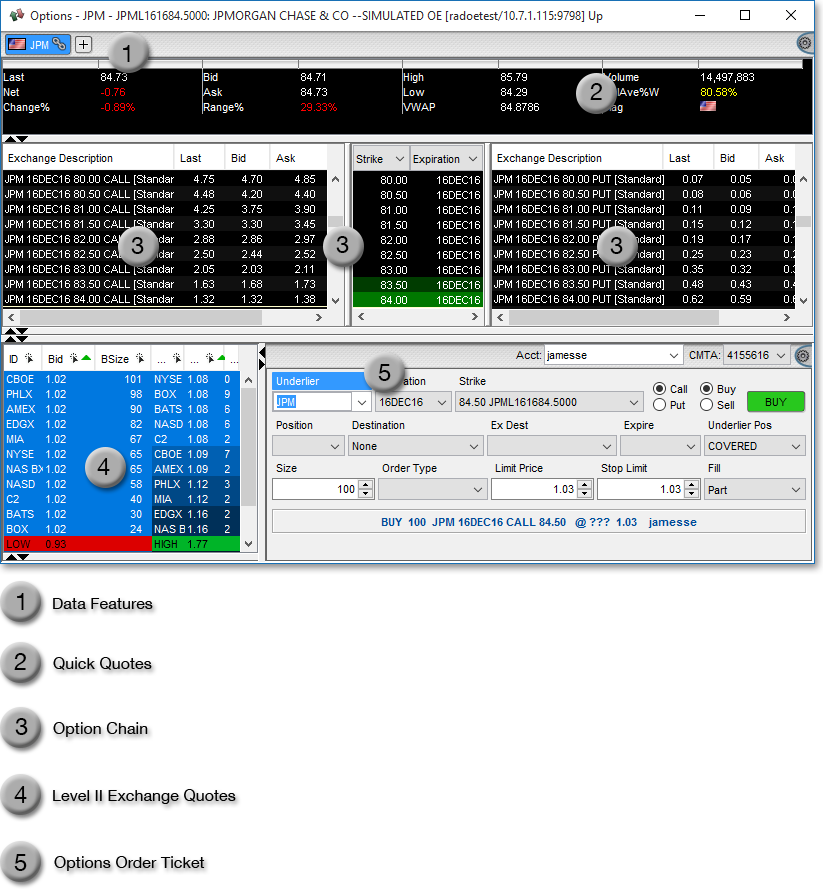

Options Window Descriptions

Neovest's Options window functionality lets you choose to (1) show either only the options that expire on a specified month or all of the options that are set to expire on an individual symbol; (2) show either all the options currently available on an individual symbol or narrow the number of displayed options to those that are currently "At the Money" or are a number of price tiers away from the "At the Money" price; and (3) specify the exchanges from which an Options window is to receive options data, ranging from letting you view options data from all available exchanges to select individual exchanges.

Additionally, as part of Neovest's Options preferences, you may specify your desired options pricing model and individually customize each component that will be used to calculate the value of each Greek display field in your Neovest account. And you may choose to include additional sections to the standard Options window via the preferences box.

The following table describes several components in Neovest's Options window. By using the following table as a guide, you may better understand how to manipulate an individual symbol's options data in a Neovest Options window and manipulate the Options window itself, thus allowing you to trade the options you wish more effectively.

| Feature: | Description: |

| All In List | Lets you choose to show all of the options that are currently available on an individual symbol or to show only those options that expire on a certain month. The default for this feature is "All In List," but you may click on the down arrow to select a single month. Once a single month is selected, the Options window will only show the options on the entered symbol that expire on the selected month. |

| Show All | Lets you choose to (1) "Show All" of the options that are currently available on an individual symbol, (2) only show those options that are currently "At the Money," or (3) only show those options that are one to thirty price tiers away from the "At the Money" price. By using the default color of green in an Options window, Neovest automatically reveals the "In the Money" call and put options, which are the options closest in price to the current trading price of an individual symbol. Instead of viewing all of the options that are currently available on an individual symbol, you may click on the down arrow and select "At the Money" or "1," "2," "3," etc., to narrow the number of displayed options in the Options window. |

| Options Window Toolbar | Lets you click on one of the horizontal row of icons to access a Neovest feature or window. For information regarding the function of each icon in Neovest's Options window toolbar, refer to the "Options Toolbar" section in the "Options" chapter of Neovest's Help documentation. |

| Composite | Shows the exchanges from which an Options window is receiving options data. Neovest currently provides multiple selections that range from letting you view options data from all available exchanges to select individual exchanges. For information regarding selecting exchanges, refer to the "General Tab" preferences section in the "Options" chapter of Neovest's Help documentation. |

The following table describes several components of the put and call Options sections in Neovest's Options window.

| Feature: | Description: |

| Symbol | Shows the ticker symbol entered for each order or for each group of bunched orders. |

| Last | Shows the last price of each symbol. |

| Net | Net change between the current price (last) and the previous day's close. |

| CurVo | Current volume is the number of stocks, bonds, options, and other investments being bought and sold at the present moment. |

| Delta | Greek value representing the expected movement of an options price in relation to a stock's movement. This value is based on a $1 movement of the underlying stock. For example, if a call has a delta of $0.30 and the stock increases by $1, then the price of the call should also increase around $0.30, assuming no other factors have changed. If the same stock decreases by $1, then the price of the call should also decrease about $0.30, assuming no other factors have changed. |

| Gamma | Greek value representing the market sensitivity of an option to second-order time-price sensitivity, specifically the rate of change for delta with respect to the underlying asset's price. Mathematically, gamma is the first derivative of delta and is used when trying to gauge the price of an option relative to the amount it is in or out of the money. When the option being measured is deep in or out of the money, gamma is small; when the option is near the money, gamma is largest. |

| ImpVol | The implied volatility is expressed as a percentage, indicating the predicted potential a stock has for increasing or decreasing in value for a future period of time. For instance, if a stock that has been purchased for $50 has a 20% implied volatility, then there is a general consensus within the marketplace that that stock could deviate plus or minus $10 within the next twelve months. Options traders include the implied volatility of a given stock to determine its potential price range and the timing of that price’s fluctuation. However, since the implied volatility is a prediction of future trends, it is not an infallible resource. |

| Intrin | The intrinsic value represents the profit an options trader would gain from buying or selling an in-the-money option. For call options, this is determined by calculating the difference between the underlying stock’s price and the strike price. For put options, this is determined by calculating the difference between the strike price and the underlying stock’s price. |

| Lambda | Greek value representing the relation of an option’s contract price to the volatility of its underlying price. When an option’s lambda is high, then its price is more sensitive to small changes in the underlying price. When the lambda is low, then the option price is less affected by changes in the underlying price. |

| OP-TV | An option's time value is comprised of the period of time left on an option's contract before it expires and the likelihood of said contract being in-the-money within that period of time. This value is typically calculated as the difference between the contract's premium and intrinsic value. |

| Rho | Greek value representing the rate at which the price of an option changes relative to a change in the risk-free rate of interest. Rho measures the sensitivity of an option to a change in interest rate. For example, if an option has a rho of 12.124, then for every percentage point increase in interest rates, the value of the option increases 12.124%. |

| Theta | Greek value representing the measure of the rate of decline in the value of an option due to the passage of time. Theta can also be referred to as the time decay on the value of an option. If everything is held constant, then the option will lose value as time moves closer to the maturity of the option. For example, if the strike price of an option is $1,150 and theta is 53.80, then in theory the value of the option will drop $53.80 per day. |

| ThVal | The theoretical value for options and futures contracts is a calculated estimation of the contract’s worth based off their past performance in the market. |

| TVP | An option's time value premium is the amount by which an option's total price exceeds its intrinsic value. As an option reaches its expiration date, its time value premium generally decreases. |

| Vega | Greek value representing the amount that the price of an option changes compared to a 1% change in volatility. Vega changes when there are large price movements in the underlying asset, and Vega falls as the option gets closer to maturity. Vega can change even if there is no change in the price of the underlying asset as a result of a change in expected volatility. For example, if the Vega of an option is -96.94 and if implied volatility were to rise by 1%, then the option value would fall by $96.94. |

| Volume | Total amount of volume traded during the current day. |