Creating an Options Spread

The following instructions explain how you may create an options spread in a Neovest Spreads (Options Strategies) window:

Options-Only Strategies

Click the "Spreads" icon on Neovest's Launch Pad.

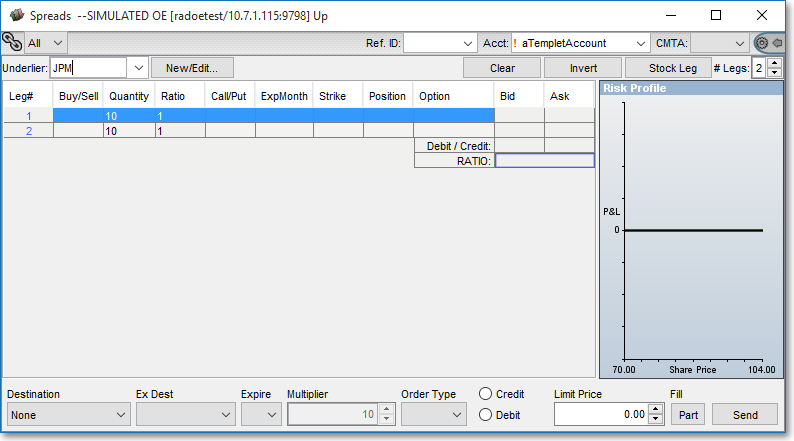

Once the Spreads window appears, type the underlying stock you wish in the "Underlier" box, and press the Enter key.

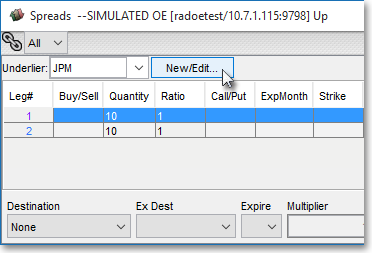

Click the New/Edit button.

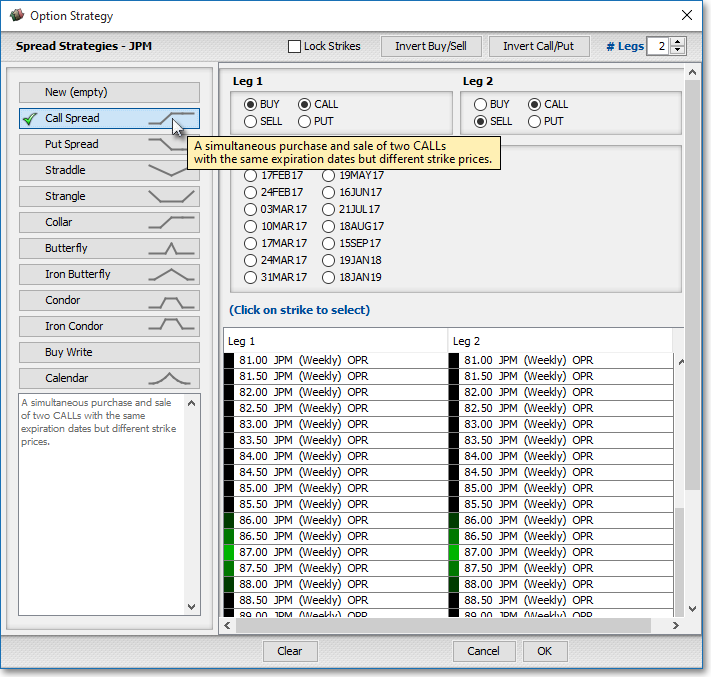

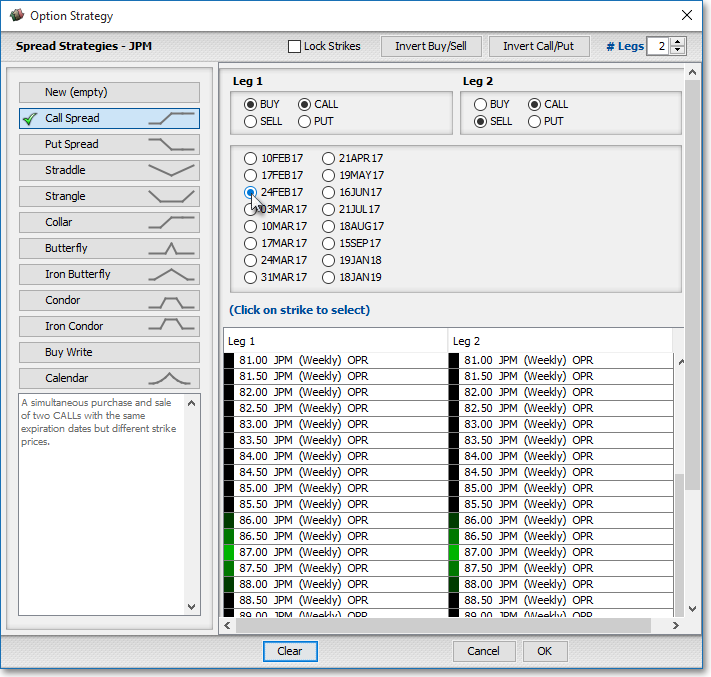

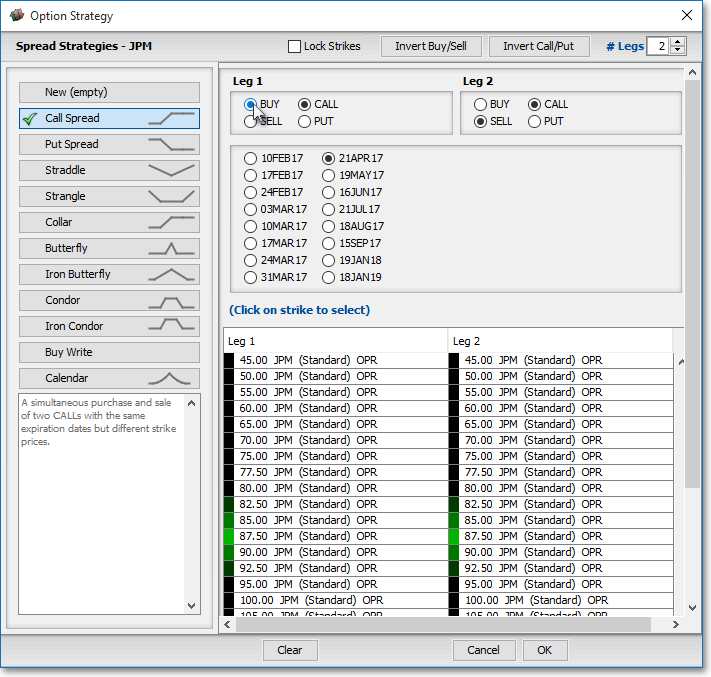

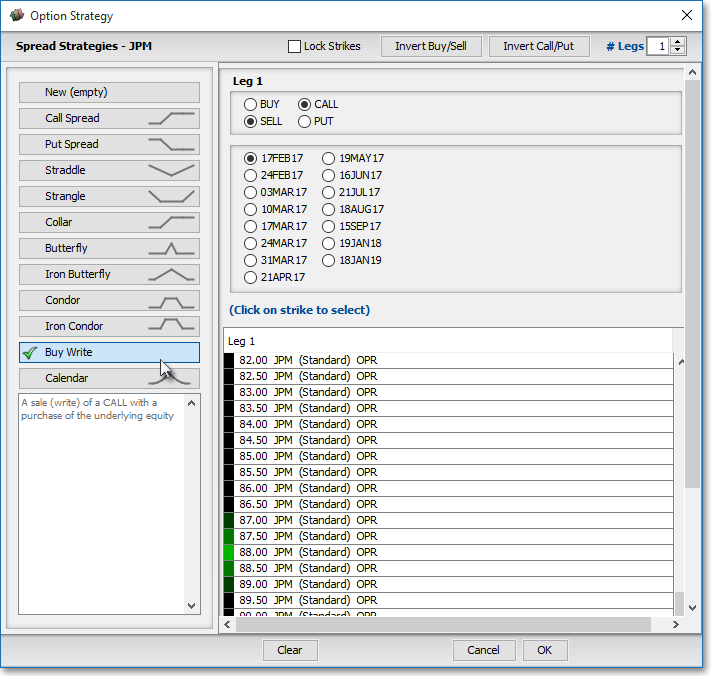

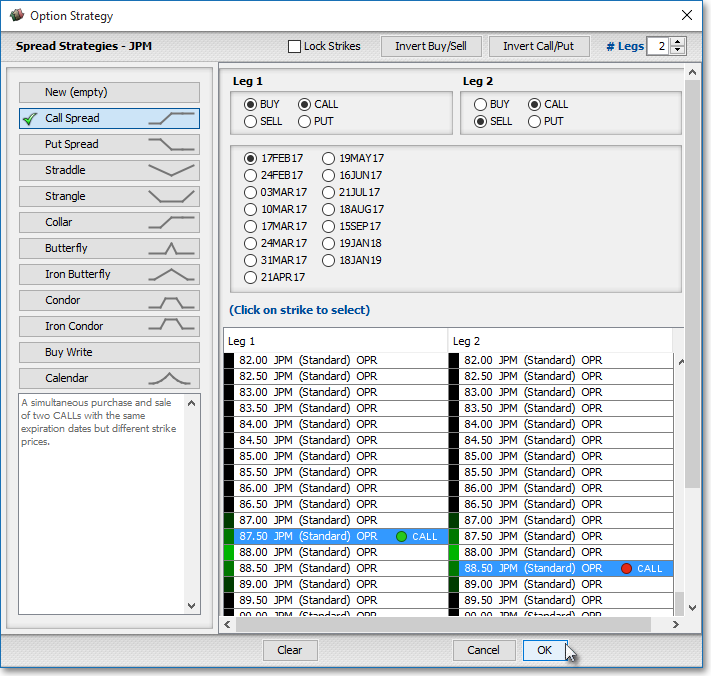

Once the "Option Strategy" box appears, select a strategy such as Call Spread, Put Spread, Straddle, Strangle, Collar, Iron Butterfly, and so on. In the following example, Call Spread is selected.

While still in the "Option Strategy" box, select the expiration month you wish.

Notice that the Buy or Sell and Call or Put are now set according to the option strategy you selected.

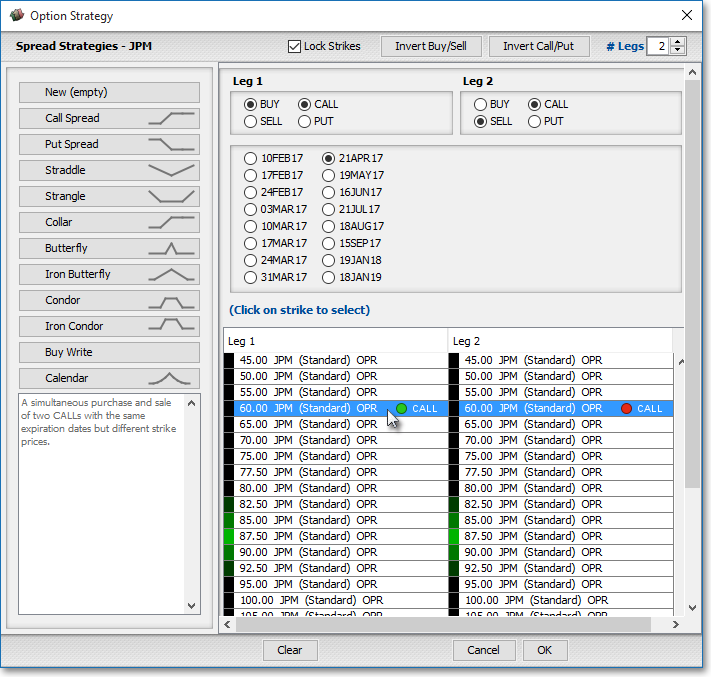

Select the strike for each leg. If you select Lock Strikes, then Leg 1 and Leg 2 will synchronize strike prices as you select different values.

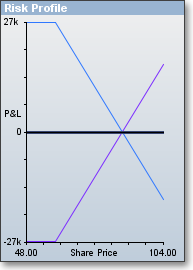

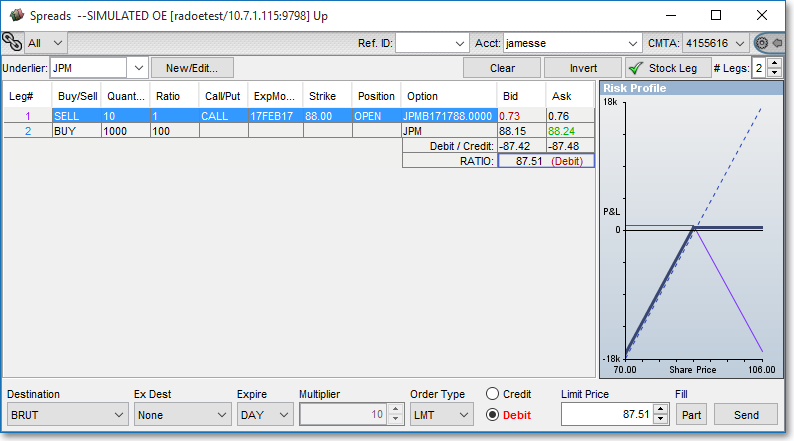

Note: As you select the expiration and the criteria for the legs of your spread, notice that the option ticket in your Neovest Spreads window is populated with the data. Also, as these data are selected, the "Risk Profile" section of the option ticket shows the potential profit and loss of the spread, based off of real-time data for the day.

Strategies with Stock Legs

Once you select criteria for each stock leg, if a particular destination supports stock legs in relation to its option spreads functionality, the destination will buy, sell, or sell short the number of shares entered for each leg. For example, the Buy Write and Collar strategies buy stock according to the stock leg in the ticket and sell the corresponding number of call options on the shares.

(The graphic below shows the option spread ticket with the stock leg component.)

Once you complete your selections in the "Option Strategy" window, click OK.

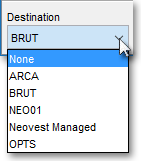

Once you return to the Spreads window itself with the option ticket displaying the "Option Strategy" data you selected, select the destination you prefer.

Note: When selecting a destination, you must only choose from those destinations that support your selected strategy.

Next, continue to fill in the remainder of the option ticket criteria, such as "Ex Dest" (broker strategy), "Expire," and "Order Type."

Note: Once you reach "Limit Price," keep in mind that this value is crucial and only relates to informing your selected destination when it is appropriate to execute the option spread, which will result in the execution of two or more option orders.

Next to "Limit Price" Neovest will show either a credit or debit based off the price of what you're selling and buying. For example, if the options you wish to buy are $8 and the same options of the underlier are $2 to sell, then the Limit Price would reflect the debit number between the call spread. With both credit and debit spreads, if a particular spread is greater than or equal to the Limit Price, the spread will be executed, and the spread is treated as two or more separate orders.

Once you finish entering the criteria you wish for a particular option spread, click Send.